When it comes to managing the finances of a business, bookkeeping and accounting play crucial roles. From keeping track of financial transactions to preparing financial statements, we will discuss the key aspects of both bookkeeping and accounting and how they contribute to the overall financial health of a company. Whether you are a small startup or a large corporation, having a solid understanding of bookkeeping and accounting is essential for making informed financial decisions.

But what’s the difference between the two fields?

Bookkeeping

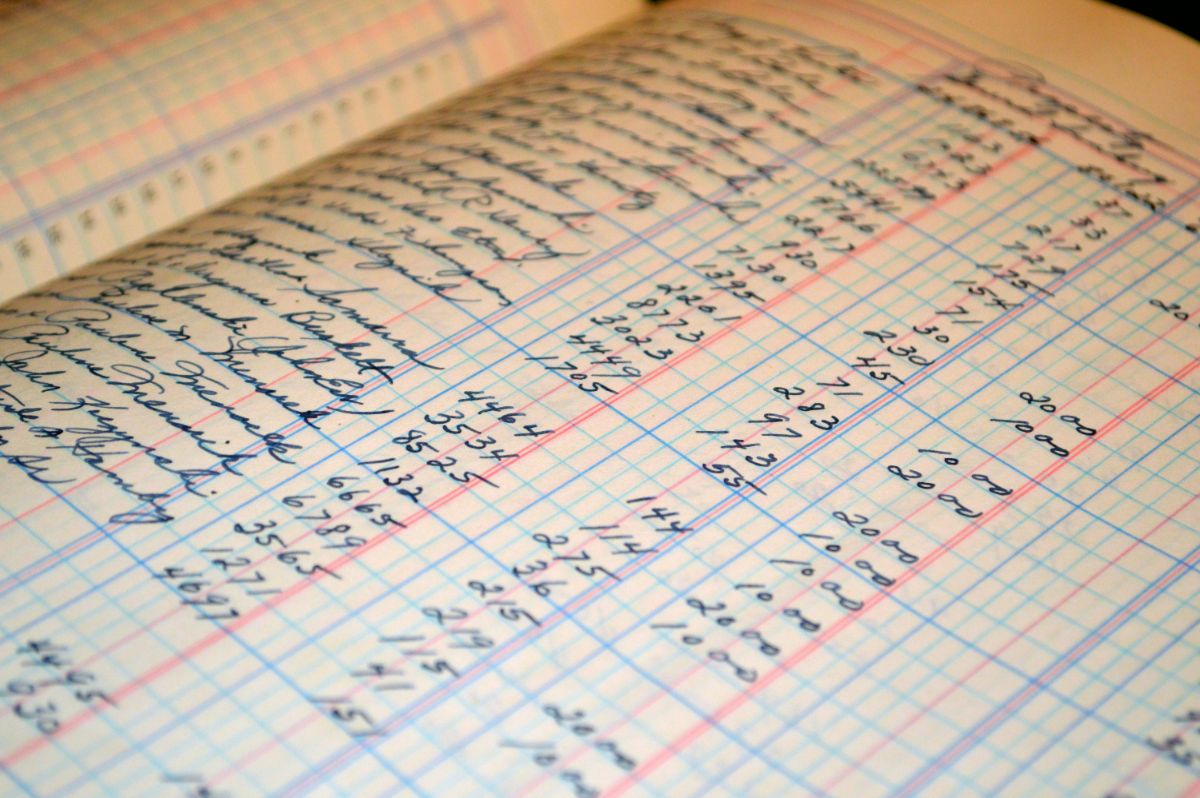

The bookkeeping process is a fundamental part of the financial management of any business. It involves recording and organizing a company’s finances on a day-to-day basis. Proper bookkeeping is essential for tracking income and expenses, maintaining accurate records, and ensuring compliance with tax laws and regulations.

The function of bookkeeping

The function of bookkeeping is to accurately and systematically record all transactions of a business. This includes tracking income, expenses, and other monetary activities to provide an accurate financial record for the company. Key components of bookkeeping include maintaining financial documents, record-keeping, and using accounting software such as QuickBooks to organize and categorize transactions.

Advantages of a bookkeeper

Bookkeepers offer organizational services that are essential for tracking and maintaining accurate records. They can help track and organize expenses, income, and other financial duties, ensuring that everything is accurately recorded and up to date. This level of organization can make tax time much easier and less stressful.

Another significant advantage of hiring a bookkeeper is cost savings. While it may seem like an added expense, the expertise and time that a bookkeeper brings to the table can actually save a company money in the long run. By keeping financials in order, a bookkeeper can help avoid costly mistakes and legal penalties.

Accounting

The accounting process is also a crucial aspect of any business, providing a clear picture of the company’s financial health and performance. The role of accounting includes tracking and analyzing the financial data generated by bookkeepers. This helps the business make informed decisions and ensures compliance with industry practice.

The function of accounting

Accounting involves the recording, summarizing, analyzing, and reporting of transactions to provide accurate and timely information for decision-making. The key roles of accounting for Bay Business Group include:

1. Financial Reporting: Accounting provides accurate and transparent financial statements, including the balance sheet, income statement, and cash flow statement, to help stakeholders assess the company’s financial performance.

2. Audits: Accounting ensures compliance with financial regulations and standards by conducting internal and external audits to verify the accuracy and reliability of financial information.

3. Tax Services: Accounting helps with tax planning, preparation, and compliance to minimize tax liabilities and ensure adherence to tax laws and regulations.

Advantages of an accountant

Hiring an accountant for your business, such as Bay Business Group, can provide numerous advantages. An accountant can offer valuable financial analysis and strategic advice in addition to their traditional tasks of tax preparation and filing.

They can also assist with legal and regulatory compliance, ensuring that your business adheres to all relevant laws and regulations. When it comes to tax preparation, an accountant’s expertise can help minimize tax liability and maximize deductions, saving your business money in the long run. Their understanding of complex tax laws and regulations can also help avoid costly errors or audits.

Hiring an accountant can ultimately provide peace of mind, knowing that your business’s financial matters are being handled by a qualified professional. Overall, the benefits of having an accountant on board for tasks such as financial analysis, tax preparation, and legal assistance can greatly contribute to the success and growth of your business.

Bookkeeping vs. Accounting – Summarized

Bookkeeping and accounting are both essential functions in managing financial data for businesses.

Bookkeeping involves the recording of financial situations, such as purchases, sales, and payments, and is crucial for maintaining accurate and up-to-date financial records. A bookkeeper may use software to track and record these transactions, ensuring that all income and expenses are properly documented.

Accounting, on the other hand, involves the analysis, interpretation, and summarization of financial data to help business owners make informed decisions. An accountant may prepare financial statements, perform financial analysis, and provide insights into the financial health of the business.

While bookkeeping focuses on the daily transactions, accounting takes a more strategic approach by using the data from bookkeeping to provide valuable insights for business outcomes. Both functions are important for the management of financial data, with bookkeeping providing the groundwork for accurate accounting and providing the analysis and interpretation of that data.

For example, a bookkeeper may track all the sales and expenses of a business using accounting software, while an accountant may use that data to prepare financial reports and analyze the overall financial performance of the company.

Ultimately, both bookkeeping and accounting play a vital role in the financial management of a business and often require a credential such as a Certified Public Accountant (CPA) for accounting or a Certified Bookkeeper for bookkeeping.

3 signs you need a bookkeeper or accountant

Three clear signs that indicate it’s time to hire a bookkeeper or accountant are:

1. Growing Complexity: If the company is experiencing growth, expansion, or an increase in financial transactions, it may be a sign that it’s time to hire a financial professional. A bookkeeper or accountant can help manage the growing complexity of financial records and transactions.

2. Time Constraints: When the business owner or staff members are struggling to keep up with financial tasks and it’s taking time away from other important responsibilities, it may be a sign to bring in a bookkeeper or accountant. Outsourcing financial tasks can free up time to focus on core business activities.

3. Financial Errors: If there are noticeable financial errors, such as incorrect reporting, miscalculations, or discrepancies in the books, it’s a clear indication that the company could benefit from the expertise of a bookkeeper or accountant. A financial professional can ensure accuracy and compliance with regulations.

Need help deciding what you need?

When deciding on accounting and bookkeeping services for your business, it’s important to consider several key factors.

Firstly, evaluate the specific needs and goals of your business, and how each option aligns with those. This includes considering the size of your business, the complexity of your financial transactions, and the level of expertise required. Secondly, analyze the features and benefits of each option. For example, outsourcing to a professional firm may offer a high level of expertise and resources, while in-house accounting may provide more control and customization.

Additionally, consider the cost and time investment of each option. Outsourcing may be cost-effective and time-saving, while in-house accounting may require more resources but offer more immediate oversight.

By carefully considering these decision factors and how they relate to your specific needs and goals, you can make an informed choice that best serves your business’s finances – find out how we can help here.